Seller Tax Class

Objective

The Shops need a distinction for Sellers to establish whether they are selling locally in the Shop for a specific country, or if they are operating internationally

This distinction between “Local” and “International” Sellers can be used for:

- Fee calculation

- Validation of blacklisted keywords

- Quality control

- Business Intelligence (BI) analysis by the Shop

Setup

During registration, a Seller adds the country from which they operate.

- If they select the same country that the shop is located in, the Seller is marked “Local”

- If they select any other country, they are marked “International”

Example:

Shop is located in France.

In the registration form, the Seller sets “France” as the country they operate from => Seller is marked as a “Local” Seller.

Shop is located in France.

In the registration form, the Seller sets “Italy” as the country they operate from => Seller is marked as an “International” Seller.

Admin users are able to edit the value.

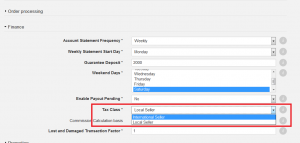

| This flag can be seen under Administration > Seller Management > Edit Seller > Finance group |

|

| The flag can be changed here; otherwise, it can be changed via CSV import of Seller settings. |

Tax Class on Quality Control

In the Quality Control Overview, quality control agents can filter for products according to which quality control rules apply to them; products created by either international or local Sellers can be filtered.